Core thesis:

More growth leading to scale, synergies, stronger moat and FCF

Debt deleveraging over the coming years leading to a stronger financial profile

SOTP value unlock via asset disposals and spinouts

Company overview:

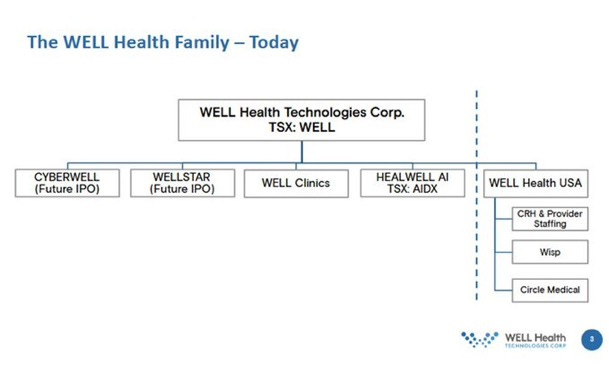

Well Health Technologies is a healthcare roll-up which primarily focuses on the Canadian clinics and SaaS market, with a substantial portion of revenues originating in the USA through its subsidiaries CRH Medical, Wisp, Radar and Circle Medical (more on this later). As can be seen below it has achieved a nr1 position in multiple verticals/areas and it is continually working to expand its dominant position even further:

The company has consistently grown revenues every single year via its continual M&A spree and organic growth:

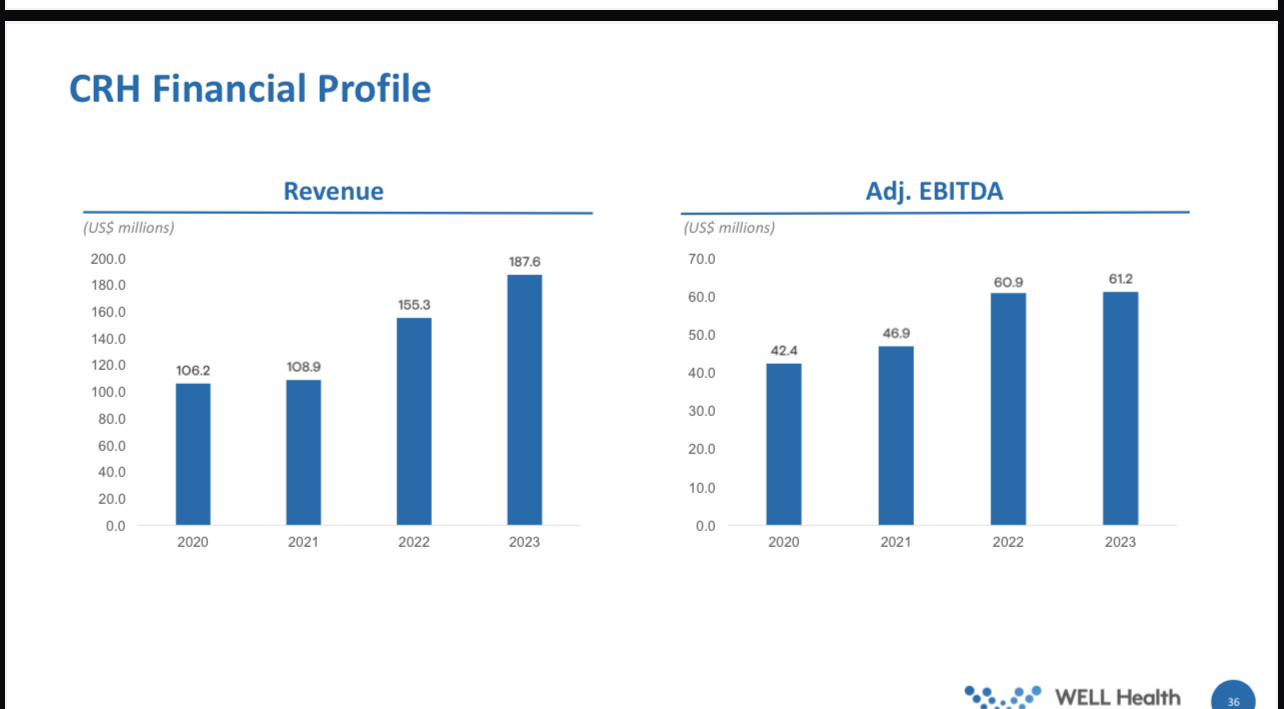

Through its acquisition of CRH in 2021 the company expanded its presence in the USA and got access to significant revenues and FCF:

This acquisition along with its MyHealth acquisition unfortunately burdened the company with quite substantial debt, currently standing at around 390m (50m of which is convertible debt which is not a part of bank debt covenants) which they pay approximately 10% interest on. Net debt stands at around 290m after having raised 50m in equity in its wellstar subsidiary. The company has guided for around 160m adj ebitda (excl circle medical), thus the leverage ratio on an ebitda basis is healthy, but on a free cashflow basis it is less flattering (more on this later).

USA business line disposal:

Recently the company has begun to seek strategic alternatives for all of its USA subsidiaries to unlock capital to deploy in its other subsidiaries. This may have come as a surprise to some investors who liked the USA subsidiaries, but I believe this move is strategically optimal.

Network synergies and strategic rationale:

The USA business lines have seen their margins deteriorate and additionally the growth is lower than that of the other subsidiaries. But there are other reasons that this move is for the best. Lets look at the synergies of clinics, wellstar, healwell and cyberwell:

(Initially I had long bullet points but condensed these with chatgpt and made a grid of it in word)

Combined:

Potential for large combined public sector wins

Strong diversification of revenues

Multipronged approach to expanding into new countries

Low costs for services between each subsidiary, increasing margins (basically vertical integration)

There is little effect or need for wellstar, cyberwell, healwell and clinics products and their growth. The USA business lines are for the most part devoid of any synergies from the other business lines growing and expanding, and the growth of the USA business lines does not contribute to the growth and strengthening of the other business lines. In effect the USA businesses are completely separate and have to fight their competitors alone. Additionally none of the USA business lines (radar, crh, circle and wisp) are synergistic with each other either, which further strengthens the case for disposing them. Additionally the CEO Hamed noted in the q1 call that the USA market is seeing more volatility as compared to their other business lines.

Note that the disposal of USA assets does not mean the company intends to exit the USA market, instead the company plans to pursue the USA market via the remaining four subsidiaries/business lines!

What could they get for these businesses?

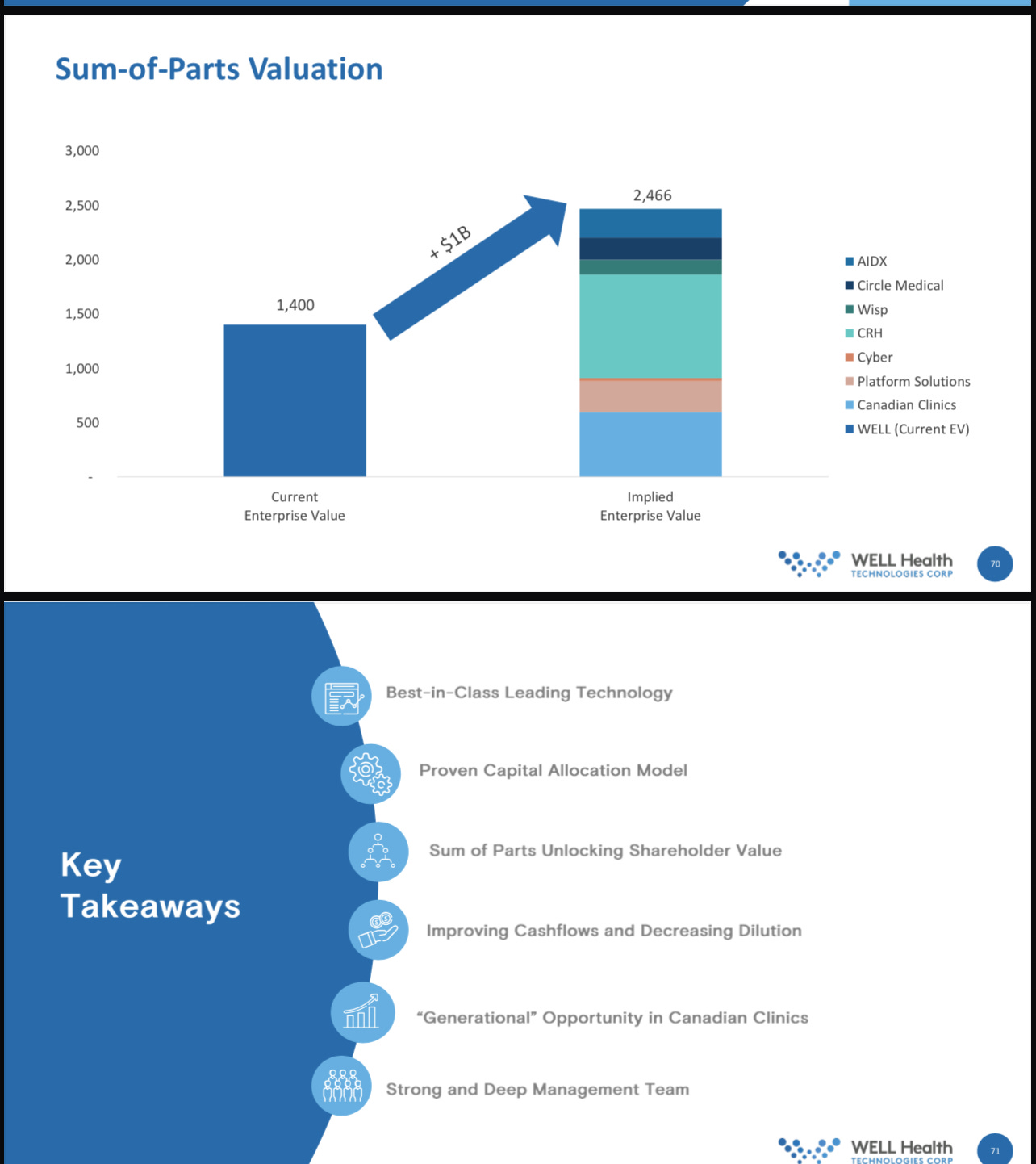

Wisp might fetch between 50-170m and circle between 70-250m (of which well would receive around 50%) and Crh+radar might fetch a combined price of between 400-600m net of debt (as per sotp slide and my own guess+management comments). Management is looking for double-digit multiples and without a compelling valuation they are unlikely to go through with a transaction.

Future growth engines:

clinics & diagnostics:

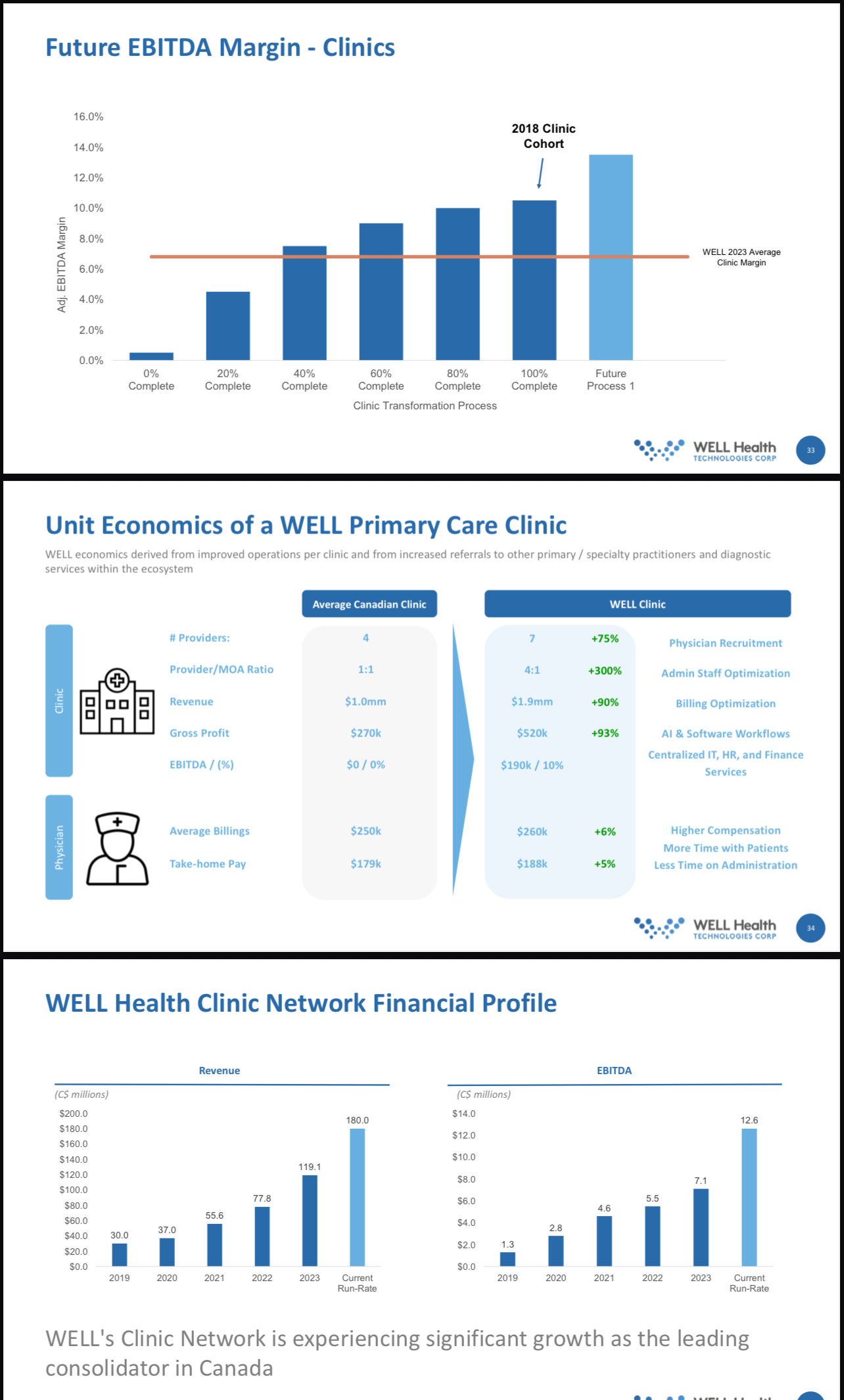

On average it takes 18 months for clinics to deliver returns of 30% ebitda on the capital spent to acquire & integrate them and reach around 8-10% margins. Currently the ebitda is understated due to many clinics not yet being optimised. The absorption model is a new way for the company to grow organically, substantially reducing the capital needed, but dragging down margins in the short term as the clinics that join usually have negative or zero ebitda margins.

Wellstar/cyberwell:

Currently wellstar is at around a 70m/y revenue run rate with 30% ebitda margins while cyberwell is currently far smaller. The company plans to spin out wellstar somewhere between the end of 2025 and early 2026. The timeline for spinning out cyberwell has not yet been given.

Healwell AI:

With the orion acquisition the company is expected to reach a revenue run rate of around 160m with positive ebitda. Well healths stake is worth around 150m and the company will consolidate healwell financials beginning in q2 2025. Well health let the company first prove itself before consolidating results to avoid posting significant losses:

Financial outlook and SOTP:

Debt & FCF:

The company leveraged up in 2021 with debt to acquire assets yielding around 5-6% fcf when the cost of that debt was close to 0. in 2021 the company did not post any FCF as it had negative working capital changes and higher capex costs.

In 2022 the company grew its ebitda but interest rates increased enough such that FCF again was around 0

Between 2022 and 2024 the company grew and the incremental roic was much better at well over 30% on ebitda, but a circle medical revenue restatement screwed up the financials such that the company again did not produce FCF.

2025 and onwards: With increased roic from tuck-in acquisitions, organic growth and decreasing interest rates along with potential cash being freed up from the USA assets it looks like the company is set to begin producing long term sustainable FCF.

SOTP:

The company acts as a steward of capital with overhead/aum costs of around 2% of annual revenues, or 15% of adj ebitda. The spinout of wellstar and the disposal of USA assets could unlock significant value to shareholders:

Green & red flags in q1 report & call:

Green flags:

Full focus on better business units (very good move by management and I'm happy they're all in now!)

Good m&a pipeline

Spinouts in ~26

Debt of ~3x ebitda (24) and ~2.4x ebitda (25), net debt: 2.2x (24), 1.8x (25). Excluding the coverts with no covenants would lower it further.

Red flags:

“Canadian business momentum"-prepares market for underwhelming USA results

Selling all USA assets -desperation

No guide up despite m&a

Guidance now with circle medical excluded (prepares market for deferred revenue not being booked as it could be replaced by new deferred revenue, md&a filing warns of this possibility)

Debt is going up rapidly without corresponding ebitda & fcf growth in the q1 quarter

Closing:

In summary the company seems to be on track to deliver on growth and FCF along with a compelling sotp value unlock, but as always its important to keep a lookout for red flags and future developments!